Instructions

Under Armor, UAA (NYSE) is headquartered in Baltimore, Maryland U.S.A.; global headquarters are in Panama, and sites include Shanghai hosts the Chinese headquarters. Other operation centers are in Paris, London, and Toronto. This company manufactures casual wear, footwear, and sports apparel.

For this week’s assignment, you will need to locate the SEC 10-K filing for Under Armour for 2016 (do not select another year); retrieve the report at www.sec.gov by clicking on Filings and then searching for Under Armour under Company Filings. When you see the list of filings for the company, select the Form 10-K for 2016. You will need this particular consolidated filing to complete your assignment this week.

Then, write a paper that addresses the following:

Introduce the company, the industry in which it operates, and the sector.

In the consolidated filing, locate the statement of cash flows and determine how much the company paid for property and equipment in 2016. Identify this section of the statement of cash flows where you find the separation.

Determine the depreciation method used in this company. Identify the range of useful lives for the company’s fixed assets.

Locate Note 3 in the filing. Looking at property and equipment for 2016 and 2015, determine the depreciation expense that was included in the calculation of net income for these fiscal years. What does this information tell you about the age of equipment over these two years? Be sure to explain your determinations.

Note 4 includes descriptions of goodwill and intangible assets how does the company account for goodwill and other intangible assets? What other types of intangible assets did the company own at the end of 2016?

Using Dupont analysis, calculate the company’s rate of return on total assets for the fiscal years 2016 and 2015. Note that total assets 2014 was $2,095 million (calculate ratios using millions); determine the performance of the company in 2016 verses 2015.

The formula for the DuPont analysis is:

Net Profit Margin × Asset Turnover × Equity Multiplier

Net Profit Margin = Net Income/Revenue

Asset Turnover = Sales/Average Total Assets

Equity Multiplier = Average Total Assets/Average Shareholders’ Equity

Length: 6 pages, not including title and reference pages

References: Include at least 5 scholarly sources. (APA 7th Editon)

– No Passive voice in this paper

Professional homework help features

Our Experience

However the complexity of your assignment, we have the right professionals to carry out your specific task. ACME homework is a company that does homework help writing services for students who need homework help. We only hire super-skilled academic experts to write your projects. Our years of experience allows us to provide students with homework writing, editing & proofreading services.

Free Features

Free revision policy

$10Free bibliography & reference

$8Free title page

$8Free formatting

$8How our professional homework help writing services work

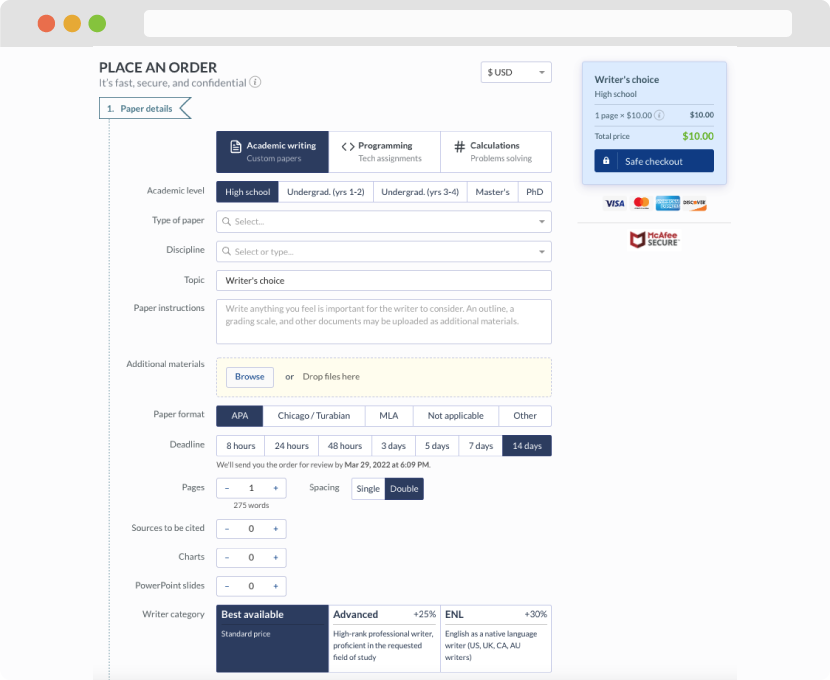

You first have to fill in an order form. In case you need any clarifications regarding the form, feel free to reach out for further guidance. To fill in the form, include basic informaion regarding your order that is topic, subject, number of pages required as well as any other relevant information that will be of help.

Complete the order form

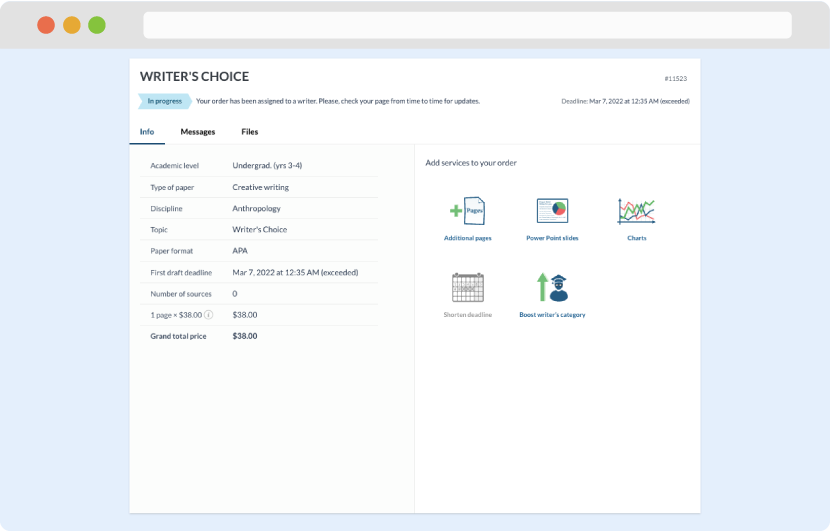

Once we have all the information and instructions that we need, we select the most suitable writer for your assignment. While everything seems to be clear, the writer, who has complete knowledge of the subject, may need clarification from you. It is at that point that you would receive a call or email from us.

Writer’s assignment

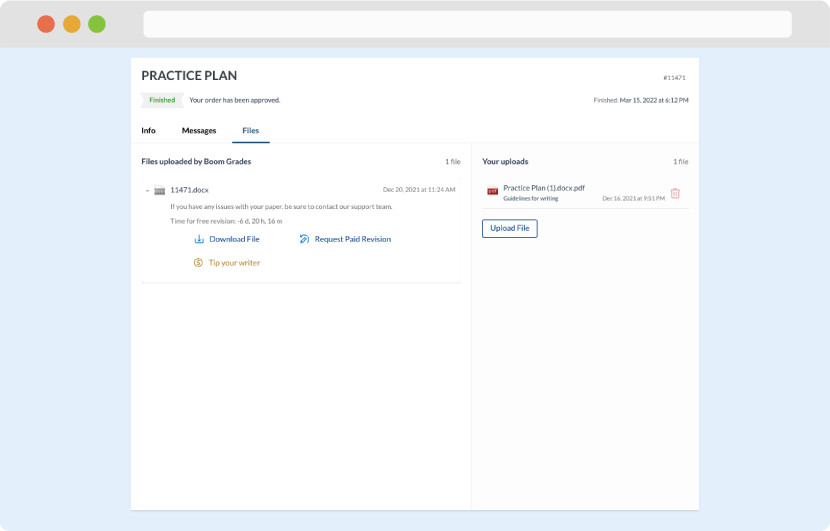

As soon as the writer has finished, it will be delivered both to the website and to your email address so that you will not miss it. If your deadline is close at hand, we will place a call to you to make sure that you receive the paper on time.

Completing the order and download