Option #1: Codification to Research a Complex Accounting Issue: The Case of Goodwill Impairment at Jackson Enterprises

Note: For this Portfolio Project, please check with your instructor for instructions, including the user name and password, which CSU-Global pays for and provides for access to the FASB Accounting Standards Codification (ASC) which you will need.

Note: The two-step impairment test was US GAAP at December 31, 2014, which is the key date for this case study. The FASB has since issued Accounting Standards Update (ASU) 2017-04, which eliminate Step 2 of the impairment test. However, for answer the requirements of this case study below, please perform the two-step impairment text which was US GAAP at December 31, 2014. For your information, today, the quantitative impairment test now includes only one step, which is the comparison of the carrying value to the fair market value of the reporting unit, with the difference representing the recognized goodwill impairment. While the quantitative aspect of the test has changed under ASU 2017-04, the FASB did not remove the preliminary, qualitative assessment option to determine the appropriateness of the quantitative test.

Read the Case of Goodwill Impairment at Jackson Enterprises (link below). After reading the case study, answer the questions provided.

Financial reporting personnel at Jackson Enterprises (JE) are in the process of completing year-end activities, including necessary adjusting of entries to the consolidated financial statements. While JE has not previously believed it necessary to adjust its recognized goodwill from the Dynamic and ZD acquisitions, the valuation of goodwill is, nonetheless, a prominent concern in the closing process. Assume you are asked to research the financial statement issues surrounding the goodwill recorded for the Dynamic and ZD subsidiaries.

Prepare a paper to address the questions below. In memorandum format, detail the issues involved, the judgements you made based on authoritative literature, and your recommendations for the direction of the goodwill valuation as it relates to Dynamic and ZA. In other words, does the evidence suggest further action is required in determining the appropriate valuation of good will? If so, what steps need to be taken?

Note: Remember that textbooks are not considered authoritative guidance in accounting research.

1. Identify and cite the relevant topics/subtopics from the FASB Accounting Standards Codification for this case.

1. Identify the specific accounting issue that you believe needs to be initially addressed for JE’s consideration of goodwill regarding both Dynamic and ZD.

2. What does the qualitative evidence from the case indicate about whether JE should perform the two-step impairment test? In your response, identify specific factors discussed in the Codification and relate them to the information provided to you in the case.

3. Beyond the assessment of qualitative factors, what other evidence should be considered for the purpose of the analysis? What does this information suggest? For Dynamic, what do you think is the most appropriate fair value amount to use in assessing the fair value of this reporting unit? Explain. Why is this important?

4. Based upon the information provided above, should Dynamic and ZD be combined or separated for the purposes of the goodwill analysis? Explain. Why is this important?

5. Based upon your initial analysis, do you think the $200 million goodwill balance (i.e., the $150 million for Dynamic and the $50 million for ZD) is the appropriate valuation for goodwill on the December 31, 2014 balance sheet of JE?

Requirements:

• Be sure to discuss and reference concepts taken from the Required and Recommended Readings throughout the course, and from your own relevant research.

• Include a cover sheet and reference page.

Your paper should be a minimum of nine pages in length, not including a cover sheet and reference page. Submissions in excess of nine pages in length are acceptable.

• Either submit a separate Excel file to support your findings or include exhibits as part of your paper.

• Include a minimum of six credible, academic, or professional references beyond the course text, Required and Recommended Readings, or other course materials.

• Format according to the CSU-Global Guide to Writing & APA (Links to an external site.).

Review the grading rubric to see how you will be graded for this assignment.

Professional homework help features

Our Experience

However the complexity of your assignment, we have the right professionals to carry out your specific task. ACME homework is a company that does homework help writing services for students who need homework help. We only hire super-skilled academic experts to write your projects. Our years of experience allows us to provide students with homework writing, editing & proofreading services.

Free Features

Free revision policy

$10Free bibliography & reference

$8Free title page

$8Free formatting

$8How our professional homework help writing services work

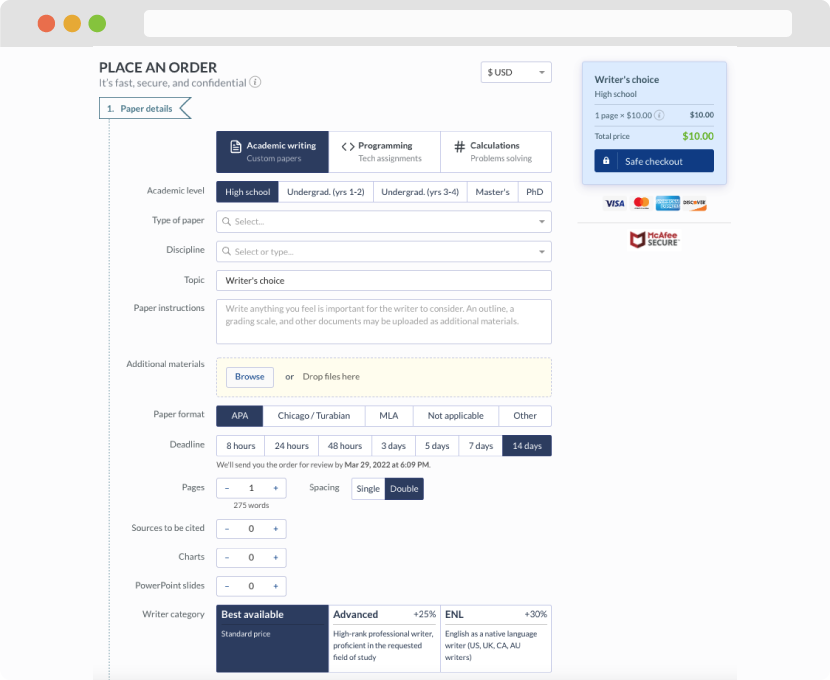

You first have to fill in an order form. In case you need any clarifications regarding the form, feel free to reach out for further guidance. To fill in the form, include basic informaion regarding your order that is topic, subject, number of pages required as well as any other relevant information that will be of help.

Complete the order form

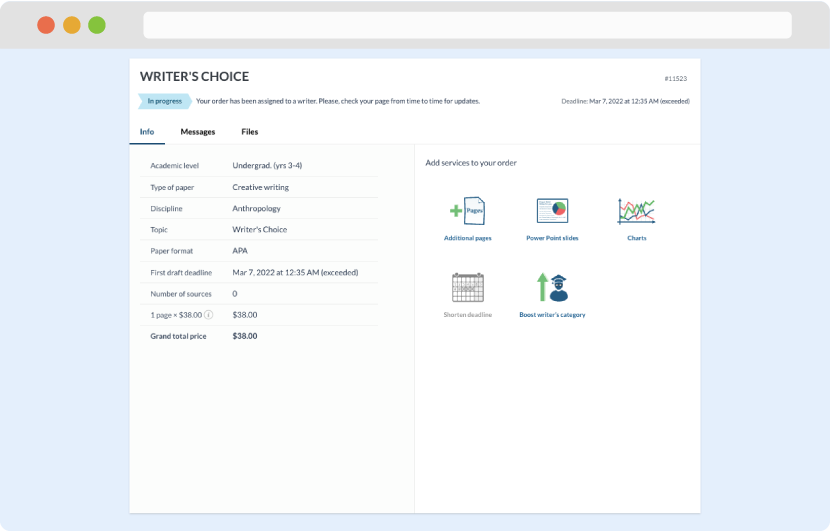

Once we have all the information and instructions that we need, we select the most suitable writer for your assignment. While everything seems to be clear, the writer, who has complete knowledge of the subject, may need clarification from you. It is at that point that you would receive a call or email from us.

Writer’s assignment

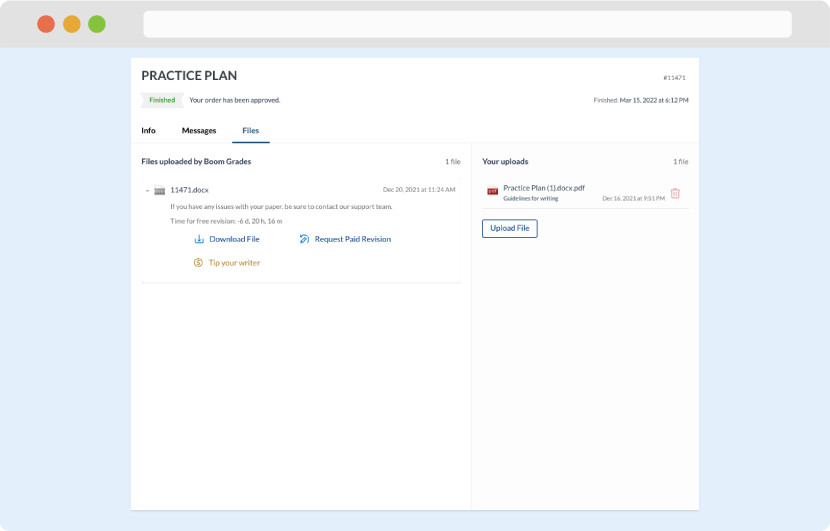

As soon as the writer has finished, it will be delivered both to the website and to your email address so that you will not miss it. If your deadline is close at hand, we will place a call to you to make sure that you receive the paper on time.

Completing the order and download