My project instructions

One day at work, Colleen and Gail start talking about the stock market and how volatile it has

been lately. Colleen asks Gail, “The market has been acting very chaotically. What do you think

is going on?” Gail replies, “Who knows. These are all short-term movements and therefore they

are completely random. On the business channels, experts try to explain every single up and

down. One expert states a reason for the market moving up and the next day another expert

uses the same reason to explain why the market is going down.”

Colleen then asks, “Well, how do you invest in a market like this then? I have some extra

savings that I want to put into action. I feel if we apply some statistics to this, we can come up

with some simple techniques that could work.” Gail responds, “There are thousands of stocks

and methods to choose from. Big institutions, private investors, and companies spend billions

of dollars to do research on how they should invest their assets. Do you want to compete with

them?”

Colleen responds, “Absolutely not. But you said it yourself that with all their expertise they still

cannot tell the future! No one can. So, let’s try to come up with a couple of methods for fun and

see how we can predict a range for the near-term market value. In fact, let’s concentrate on the

S&P 500 index which is a good indicator for the stock market.”

Gail shakes her head, “Let’s give it a try. To keep the values smaller why don’t we concentrate

on an ETF (Exchange Traded Fund) that is based on the S&P 500. The common one that

everyone uses is SPY, it mimics the S&P 500 movement approximately.” Colleen says, “That

sounds good. Let’s look at the daily chart of SPY and see what we can come up with.” They

quickly get behind a computer terminal and check out the prices of SPY for the last three

months. Looking at a bar graph, Colleen asks, “Which of these values should we take as the

price: the open, the close, the low or the high?”

Gail responds, “I assume that we are only going to look at the price action. It looks like the

trading volume is large enough for each day that perhaps we can ignore it for now. Back to your

question, the highs and lows are really the daily extremes. Let’s find a 90% confidence interval

for the highs and one for the lows. Then we can use the upper value of the confidence interval

for the highs as a sell signal and the lower value of the confidence interval for the lows as a buy

signal. There you go, you have one method.”

Colleen thinks a little and says, “That’s a good one, but it is too conservative. I want to get into

the daily action more often. You agree that the opening and closing prices are more

representative of the ‘actual’ value of SPY, right?” Gail replies, “That’s right.” Colleen continues,

“Why don’t I take the midpoint for opening and closing prices of each day and then do a 99%

confidence interval on the midpoints of the opening and closing prices. Once I have that range,

then I can sell SPY when its price reaches the upper limit of the confidence interval and buy SPY

when it comes close to the lower limit. That works, doesn’t it?”

Gail responds, “On paper, everything works. We really need to do some tests before you even

think about applying either one of these methods. There are many other things that we should

consider too.” Colleen looks at the clock, “I know. Don’t worry, I won’t be doing any investing

right away. I will do some more research. Lunch time is up, we need to go.” As they depart for

work, they both wonder how well their methods would work.

Determine a 90% confidence interval for the average daily low prices of SPY and a 90%

confidence interval for the average daily high prices. Find the midpoint of the opening and

closing values for those same days and call it the “Price” of SPY for that day. Compute a 99%

confidence interval for the average “Price” of SPY. (Make sure to get the data from a reliable

financial site. The last 30-trading day data on SPY will suffice.) Describe at what values SPY

should be bought or sold according to Gail’s method. How about the trading values for

Colleen’s method?

Solve and write a detailed solution

Professional homework help features

Our Experience

However the complexity of your assignment, we have the right professionals to carry out your specific task. ACME homework is a company that does homework help writing services for students who need homework help. We only hire super-skilled academic experts to write your projects. Our years of experience allows us to provide students with homework writing, editing & proofreading services.

Free Features

Free revision policy

$10Free bibliography & reference

$8Free title page

$8Free formatting

$8How our professional homework help writing services work

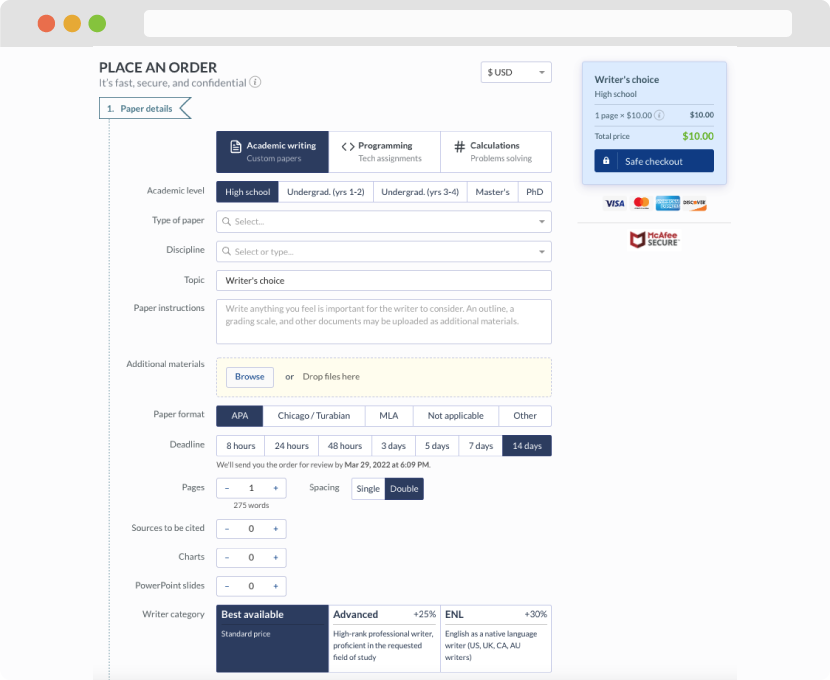

You first have to fill in an order form. In case you need any clarifications regarding the form, feel free to reach out for further guidance. To fill in the form, include basic informaion regarding your order that is topic, subject, number of pages required as well as any other relevant information that will be of help.

Complete the order form

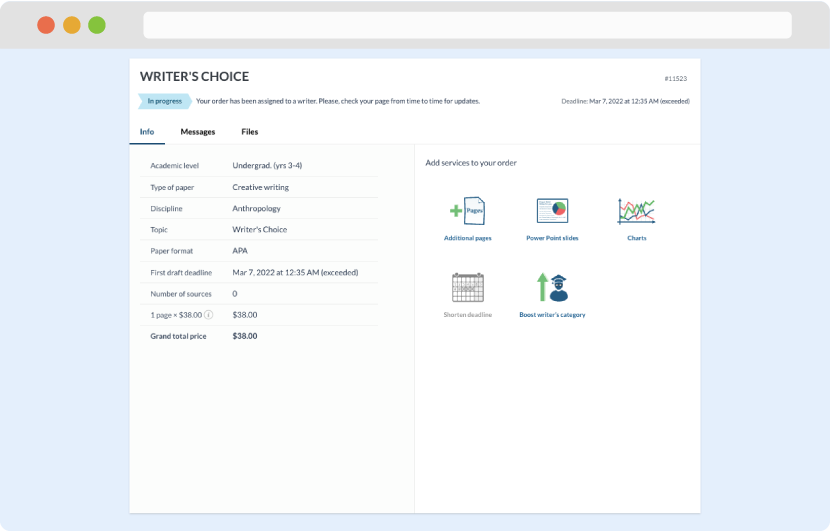

Once we have all the information and instructions that we need, we select the most suitable writer for your assignment. While everything seems to be clear, the writer, who has complete knowledge of the subject, may need clarification from you. It is at that point that you would receive a call or email from us.

Writer’s assignment

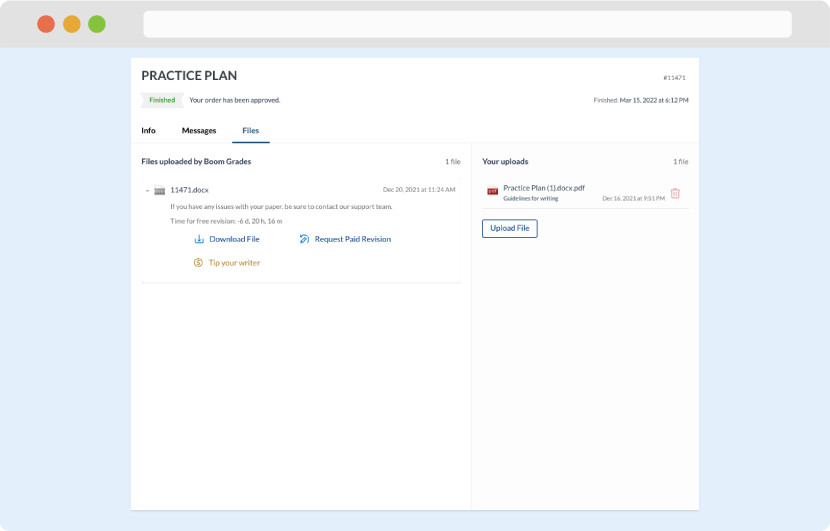

As soon as the writer has finished, it will be delivered both to the website and to your email address so that you will not miss it. If your deadline is close at hand, we will place a call to you to make sure that you receive the paper on time.

Completing the order and download