2nd Term, SY 2019 – 2020

FINAL REQUIREMENT

ADM M004/International Financial Management

I. CAPITAL BUDGETING

Direction: Carefully read and analyze the requirements below. Identify what is being asked for.

A company has three projects under consideration. The cash flow for each of them is shown in the following table. The firm has a 10 percent cost of capital.

PROJECT PROJECT X PROJECT Y PROJECT Z

Initial Investment 750,000 750,000 750,000

Annual Cash Inflows:

Year 1 280,000 560,000 350,000

2 280,000 240,000 200,000

3 280,000 200,000 250,000

4 280,000 200,000 300,000

5 280,000 200,000 300,000

Requirements:

1. Calculate each project’s payback period.

2. Calculate each project’s net present value.

a. Indicate if the project is acceptable or not. Write ACCEPT OR REJECT.

b. Which project is preferred?

3. Comment on your findings in 1 and 2, recommend the best project. Explain your recommendation.

II. LEVERAGE

Direction: Carefully read and analyze the requirements below. Identify what is being asked for.

RBF Corporation makes a patented product that wholesales for $6.00. Each product has variable operating costs of $3.50. Fixed operating costs are $50,000 per year. The firm pays $13,000 interest and preferred dividends of $7,000 per year. At this point, the firm is selling 30,000 units per year and is taxed at a rate of 40%.

a. Calculate operating breakeven point.

b. On the basis of the firm’s current sales of 30,000 units per year and its interest and preferred dividend costs, calculate its EBIT and earnings available for common.

c. Calculate the firm’s degree of operating leverage (DOL).

d. Calculate the firm’s degree of financial leverage (DFL).

e. Calculate the firm’s degree of total leverage (DTL).

f. The company has entered into a contract to produce and sell an additional 15,000 latches in the coming year. Use the DOL, DFL, and DTL to predict and calculate the changes in EBIT and earnings available for common. Check your work by a simple calculation of Carolina Fastener’s EBIT and earnings available for common, using the basic information given.

III. WORKING CAPITAL MANAGEMENT

Direction: Carefully read and analyze the requirements below. Identify what is being asked for.

As a financial adviser of Buenaflor Corporation, the company is asking for your assistance with the management of their cash conversion cycle. The company is using 360 days per year. The company gave you the following information:

a. Average age of inventory = 60 days

b. Average collection period = 30 days

c. Average payable period = 20 days

d. Firms total spending on operating cycle per year = Php20,000,000.00

A) How many days would take an operating cycle to be completed?

B) How many days would take a total cash conversion cycle?

C) How much will Buenaflor Corporation need to support the cash conversion cycle?

D) How much is the daily cash operating cycle?

E) The company is choosing for two options to reduce the resources invested:

Option 1: Reduce accounts receivables by 5 days.

Option 2: increase accounts payables by 7 days

As an adviser which of the two options would you recommend? Support your recommendation with proper solutions.

Professional homework help features

Our Experience

However the complexity of your assignment, we have the right professionals to carry out your specific task. ACME homework is a company that does homework help writing services for students who need homework help. We only hire super-skilled academic experts to write your projects. Our years of experience allows us to provide students with homework writing, editing & proofreading services.

Free Features

Free revision policy

$10Free bibliography & reference

$8Free title page

$8Free formatting

$8How our professional homework help writing services work

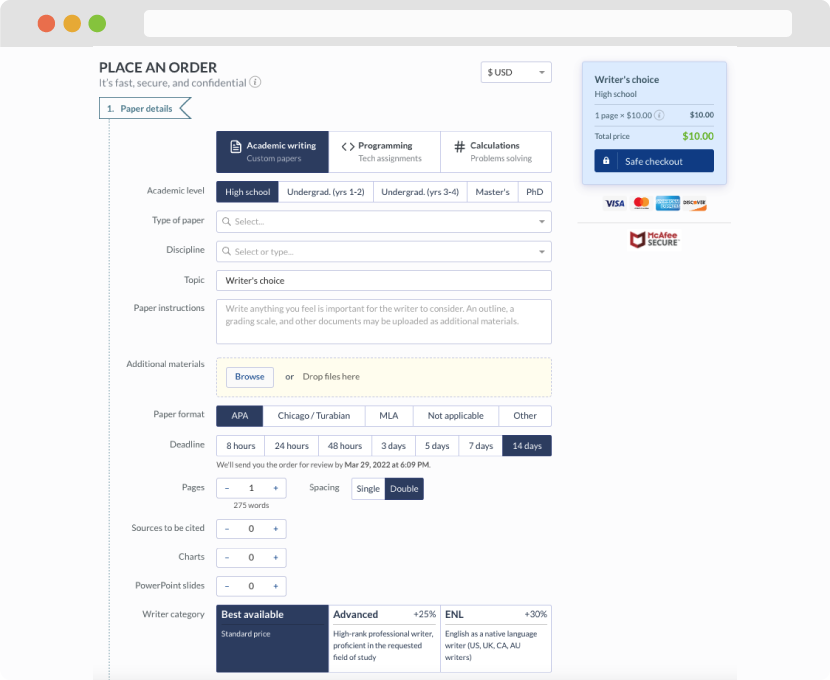

You first have to fill in an order form. In case you need any clarifications regarding the form, feel free to reach out for further guidance. To fill in the form, include basic informaion regarding your order that is topic, subject, number of pages required as well as any other relevant information that will be of help.

Complete the order form

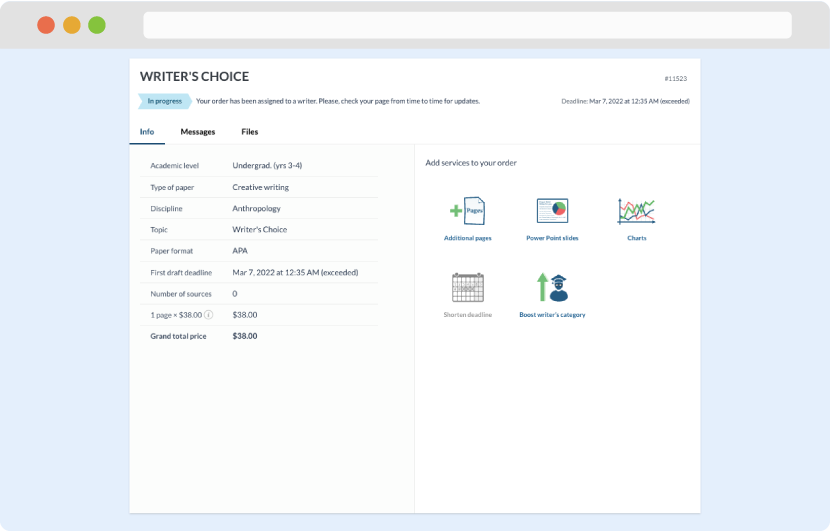

Once we have all the information and instructions that we need, we select the most suitable writer for your assignment. While everything seems to be clear, the writer, who has complete knowledge of the subject, may need clarification from you. It is at that point that you would receive a call or email from us.

Writer’s assignment

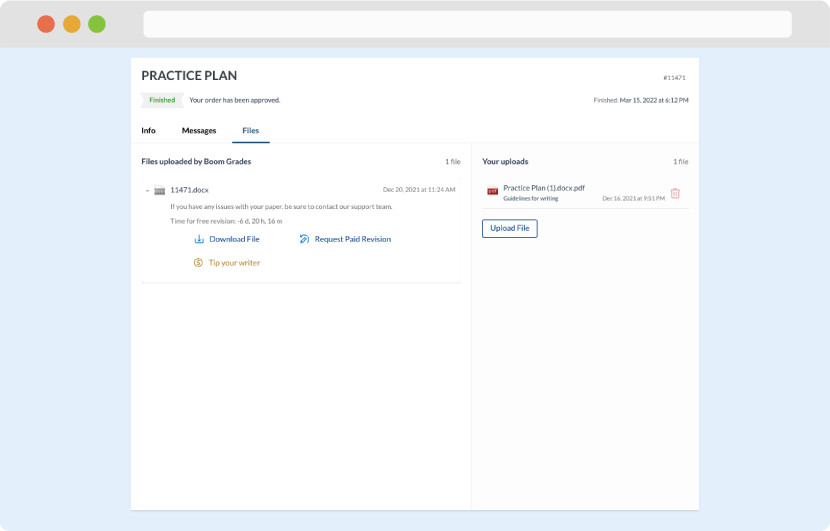

As soon as the writer has finished, it will be delivered both to the website and to your email address so that you will not miss it. If your deadline is close at hand, we will place a call to you to make sure that you receive the paper on time.

Completing the order and download