Create a 6-8 page report that analyzes financial ratios for a selected company, uses the data to

tell the financial story of that company, and concludes with a recommendation on whether the

company would be a viable partner based on its financial condition.

Scenario

Maria Gomez is founder and president of PacificCoast Technology, a small technology

company. She is considering being bought out by a larger publicly traded company so she can

be rewarded financially for all of her entrepreneurial efforts. She calls you into her office and

says:

Thank you for meeting with me today. I’d like to talk to you about the future of the

PacificCoast Technology. I’ve been running this company for a long time now, and I

think it’s time for me to consider the next five to ten years. I want to find a buyer for

this company who can take it to its full potential but with me still leading it. I still

want to be a part of the journey, to see this company’s growth, which means this

potential buyer needs to be a high quality company with solid financial health.

That’s the only way we’ll be sure there’s going to be necessary funds and stability

for the firm to grow.

You are ready to take on this project to assist Maria with her vision to find a buyer to take the

company into the next phase. At your desk, you review these additional meeting notes:

● The acquiring company does not need to be in the same industry, as Maria values

financial strength over any synergistic benefits.

● Maria wants you to select a company and then examine its financial condition by

analyzing its financial statements and using financial ratio analysis. She indicated that

using both trend analysis—going back at least three years—and industry average

analysis would be helpful information for her.

● From this analysis, Maria wants you to tell the financial story of the potential

buyer/company by listing its financial strengths and weaknesses.

● She expects you to provide a list of actionable decisions so she can understand if the

company would be a potentially viable corporate partner.

Your Role

You are one of Maria’s high-performing managers at PacificCoast Technology, and she trusts

your work and leadership.

Requirements

After a few days of thinking about Maria’s project request, you call a meeting with her in which

you lay out the requirements below. You tell her that by meeting these requirements, you

believe she will have the information she needs. Maria approves your plan and asks that you

get started right away.

Here is what your report should provide for Maria on the selected company:

● Provide a brief background and summary of the potential corporate partner in terms of its

history, product lines, and geographic reach. (Remember that Maria is looking for a

partner that is a publicly traded firm.)

● Analyze the financial statements of the firm, which can be typically be found in the

annual report in the investors’ area of the corporate website, including the income

statement, balance sheet, and statement of cash flows:

○ Do a comprehensive financial ratio analysis, including multiple financial ratios in

each of the following categories—short-term solvency or liquidity, long-term

solvency, asset management or turnover, profitability, and market value ratios.

○ Use the following tools to analyze these ratios: trend analysis (going back at least

three years) and industry average ratio analysis. If industry average ratios are not

available for the company, use an average of two of its nearest competitors.

● Evaluate the financial statements and ratios of the firm to find its true condition and

valuation.

○ From the ratio analysis, identify and strengths and weaknesses of the company.

○ Make conclusions on the current status of the firm based on its history and

comparison to its competitors.

● Make actionable items and conclusions, based on the data analysis, about the status of

the company.

○ Based on the analysis of the firm, identify any general actions that need to be

made to improve the financial condition, and indicate the ease or difficulty of the

firm doing so.

● Tell the current financial story of the firm and indicate the overall health of the firm as it

relates to current valuation and the future prospects of the company.

○ Provide a clear picture of the financial condition and valuation of the company to

shareholders, debtholders, customers, and employees.

○ Present information graphically and in narrative form, conveying a compelling

snapshot of the company.

○ Recommend whether the company would be a good match to enter into a buyout

tender offer/agreement.

○ Remember that it is not enough to just simply summarize numbers or data for

your audience. Put yourself in their shoes and make the connections for them,

tell them why it is important, and tap into their concerns and motivations.

While you are free to use your creativity in formatting your submission, keep in mind that this is

a document that will be for the eyes of the owner of the firm, so make sure it can be easily and

quickly examined by a busy upper-management professional, with clear writing and

understandable graphics and charts.

Deliverable Format

Create a report that tells the financial condition of a company. Your report should provide

information on the following:

● Analysis of the financial statements.

● Evaluation of the true condition and valuation of the company.

● Recommendation of actionable items for the company based on the financial analysis.

Report requirements:

● Ensure written communication is free of errors that detract from the overall message and

quality.

● Use at least three scholarly resources.

● Your report should be between 6 and 8 pages.

● Use 12 point, Times New Roman.

If you are experienced with preparing professional reports, you may use a format of your choice.

However, if you are new to this type of writing and document style, you may wish to use these

sections as a way to organize your report:

● Title Page.

● Executive Summary.

● Company Background.

● Financial Analysis.

○ Financial Ratio Analysis.

○ Trend Analysis.

○ Industry Average Analysis.

● Conclusion.

● Recommendations.

● Appendix (if you have additional data, reports, charts, et cetera, to support your

analysis).

Professional homework help features

Our Experience

However the complexity of your assignment, we have the right professionals to carry out your specific task. ACME homework is a company that does homework help writing services for students who need homework help. We only hire super-skilled academic experts to write your projects. Our years of experience allows us to provide students with homework writing, editing & proofreading services.

Free Features

Free revision policy

$10Free bibliography & reference

$8Free title page

$8Free formatting

$8How our professional homework help writing services work

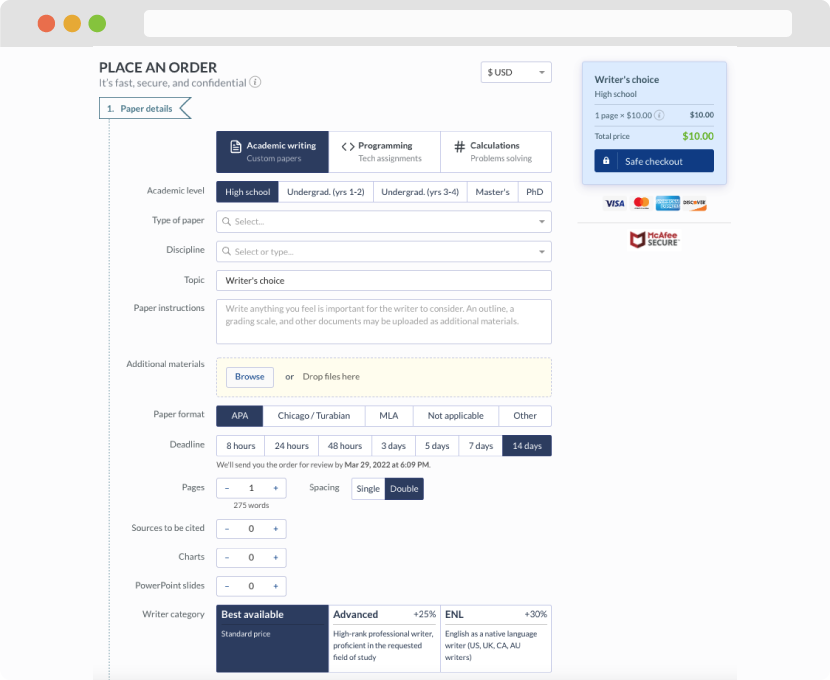

You first have to fill in an order form. In case you need any clarifications regarding the form, feel free to reach out for further guidance. To fill in the form, include basic informaion regarding your order that is topic, subject, number of pages required as well as any other relevant information that will be of help.

Complete the order form

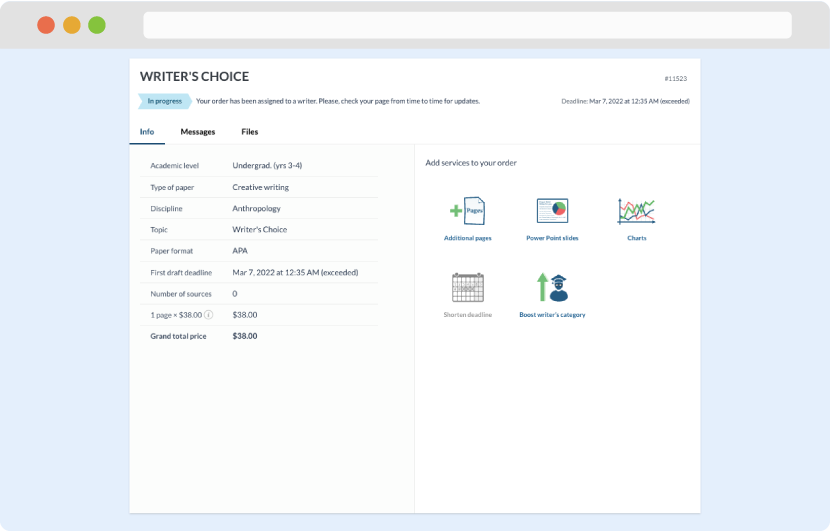

Once we have all the information and instructions that we need, we select the most suitable writer for your assignment. While everything seems to be clear, the writer, who has complete knowledge of the subject, may need clarification from you. It is at that point that you would receive a call or email from us.

Writer’s assignment

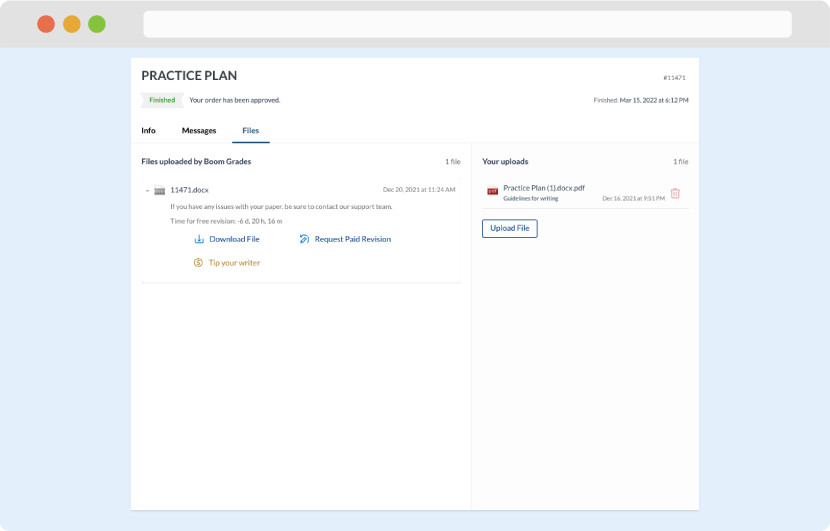

As soon as the writer has finished, it will be delivered both to the website and to your email address so that you will not miss it. If your deadline is close at hand, we will place a call to you to make sure that you receive the paper on time.

Completing the order and download