Businesses and other organizations must regularly measure their financial performance and health to make operational and strategic decisions affecting the

organization’s future. Management professionals utilize income statements, balance sheets, cash flow statements, and a variety of other reports and techniques

to evaluate an organization. They also work closely with professionals from departments across the organization—including marketing, human resources, and

operations—to ensure that the business runs smoothly and financial decisions are not made in isolation.

For this project, you will use the accounting and finance skills you learned in the course to review the past and current financial performance and health of

a global, publicly traded company. Using that analysis, you will create initial financial projections that forecast the company’s performance under different

scenarios and identify internal risks and opportunities in order to begin planning future activities.

In this assignment, you will demonstrate your mastery of the following course outcomes:

MBA-520-01: Assess an organization’s’ underlying financial performance and health by analyzing relevant financial statements, variances, ratios,

and other financial information

MBA-520-02: Draw connections between accounting and financial information and the broader organizational context for making integrated business

decisions

MBA-520-03: Assess critical factors driving financial risks and opportunities for informing management priorities

MBA-520-04: Forecast business performance under different assumptions about inputs and processes using simple financial models

MBA-520-05: Evaluate the internal costs and benefits of business opportunities for their impact on budgeting and business decisions

MBA-520-06: Communicate financial analyses clearly and coherently for persuading internal stakeholders of the validity of observations and conclusions

Prompt

Imagine you are a newly hired manager at a publicly traded, global corporation of your choosing.

You have been asked to review the company’s past and current financial performance and health and make initial financial projections in order to begin

planning for the upcoming year. Your supervisor is particularly interested in a fresh perspective on what your analysis reveals about potential risks and

opportunities, as well as recommendations for next steps. Because you will eventually need to convince internal stakeholders, including senior management, of

the feasibility and desirability of your suggested activities, it is important that you justify your projections and recommendations, explaining how they were

informed by existing information and modeling different scenarios.

Your financial analysis and projection report will include several financial tables, along with a comprehensive narrative describing the company’s context

and financial performance and health, and your analytical approach and conclusions. Your report should be geared toward an executive audience with

basic accounting and finance knowledge and should be well organized, clear, concise, convincing, and free of distracting errors. Note that, in addition to

the company’s financial statements and website, other authoritative news sources—such as annual reports and external sites like Bloomberg—may offer

insights that facilitate analysis or provide information on the company’s priorities, challenges, and geographic distribution.

Specifically, your financial analysis and projection report must include the following critical elements. Most of the critical elements align with a particular course

outcome (shown in brackets).

I. Executive Summary: Clearly and concisely summarize your principal findings, projections, and recommendations as a manager, with the goal of

persuading busy executives to support your ideas and read further. Provide your intended audience with a solid but brief sense of the parameters of

your analysis and who you would consult in refining it further, and why. Remember that your goal is to convince readers of the validity of your

observations while recognizing limitations that affect business decisions. [MBA-520-06]

II. Financial Performance and Health: In this section, you will evaluate the company’s recent financial performance and current financial health, given its

organizational context. In particular, you must cover the following:

A. Organizational Context

1. What key goods or services does your company provide, for whom, where, and why? How do these features of the company (major

products or services, customers, location, etc.) help set the boundaries for business decisions? [MBA-520-02]

2. How is the company organized and managed (by product groups, geographic region, function, etc.)? How does that affect

accounting and financial information and subsequent business decisions? [MBA-520-02]

B. Recent Financial Performance

1. Assess what the company’s consolidated income statements for the last three years say about its financial performance. Use relevant

indicators, graphs, and spreadsheets to support your narrative. (Include all spreadsheets in an appendix.) For example, what do the

amounts and year-to-year changes in revenue, operating income, net profit or loss, and earnings before interest, taxes, depreciation,

and amortization tell you? Do any items stand out? [MBA-520-01]

2. Assess what the company’s consolidated cash flow statements for the same time period say about its financial performance. Use

relevant indicators, graphs, and spreadsheets to support your narrative. For example, what do the amounts and year-to-year changes

in cash from operating activities, cash from investing, cash from financing, and total cash flow tell you? Do any items stand out? [MBA520-01]

3. Assess the company’s underlying financial performance. Support your answer with the analysis above and relevant research. For

example, is recent performance substantially affected by unusual events such as a major acquisition or spin-off? Is the business

thriving or struggling in its industry? How do you know? [MBA-520-01]

C. Current Financial Health

1. Assess how the company is capitalized and what that tells you about its financial health. Support your response with relevant graphs,

spreadsheets, and indicators such as cash and cash equivalents, total debt, shareholders’ equity, current ratio, debt/equity ratio, and

days sales outstanding (DSO). For example, does the company have enough cash for payroll and other bills? Does it have the right mix of

debt versus equity (stock)? How do you know? [MBA-520-01]

2. Does the company have the right amount of cash and other resources (e.g., key people, technologies, reputation, physical assets) to fuel

future growth? What does this suggest for business decisions? For example, if it has too much cash, should it pay a large dividend,

repurchase its own shares, or reinvest the excess funds? [MBA-520-02]

3. Assess the financial value of the company using relevant indicators. What does your assessment imply for future business health

and performance? For example, what is the business’s current market value? What is its price-to-earnings ratio? What do these

suggest about investor perceptions of the business’s future? [MBA-520-01]

III. Success Factors and Risks: Use this section to discuss the factors that may affect current and future performance. Specifically:

A. How do the company’s financial and strategic priorities affect accounting procedures and business decisions? How might that affect business

success? For example, is management growth-oriented or efficiency-oriented? What is the company’s approach to risk and short- versus longterm planning horizons? [MBA-520-03]

B. How might the company better capitalize on nonfinancial factors such as market share, reputation, human resources, physical facilities, or

patents? Support your response with relevant research and analysis. [MBA-520-03]

C. What are the most significant internal risks to the company’s financial performance? Give evidence to support your response. For example, is

the company vulnerable to technological changes or cyberattacks? Loss of high-talent personnel? Production disruptions? [MBA-520-03]

IV. Projections: Using what you know about the company’s financial health and performance, forecast its future performance. In particular, you

should:

A. Project the company’s likely consolidated financial performance for each of the next three years. Support your analysis with an appendix

spreadsheet showing actual results for the most recent year, along with your projections and assumptions. Remember that your

supervisor is interested in fresh perspectives, so you should not just replicate existing financial statements: You should add other relevant

calculations or disaggregations to help inform decisions. [MBA-520-04]

B. Modify your projections for the coming year to show a best- and worst-case scenario based on the potential success factors and risks

you identified. As with your initial projections, support your analysis with an appendix spreadsheet, specifying your assumptions and

including relevant calculations and disaggregations beyond those in existing financial reports. [MBA-520-04]

C. Discuss how your assumptions, forecasting methodology, and information gaps affect your projections. Why are your projections

appropriate? For example, are they consistent with the company’s mission and priorities? Aggressive but achievable? How would changing

your assumptions change your projections? [MBA-520-04]

V. Business Opportunities: In this section, discuss the incremental impact of a hypothetical but reasonable and simple new investment project, such as a

new product or facility or a cost-cutting investment, as an initial step in thinking about the future. Be sure to address the following:

A. Based on your knowledge of this company, what is a likely investment it would consider and why? Be sure to describe the basic features of

the investment as a foundation for considering its potential financial impact. [MBA-520-05]

B. Evaluate the approximate costs and benefits of the investment you identified, explaining how they would affect your spreadsheet

projections and business decisions. Estimates are sufficient but should be grounded in common sense and insight into the company. [MBA520-05]

C. Assess the implications of how the potential investment affects budgeting and related business decisions. For example, does the investment

involve significant cash spending this coming year, followed by benefits in the following year? How might that affect short-term and long-term

spending priorities? Does the benefit outweigh the cost? [MBA-520-05]

Milestones

Milestone One: Financial Performance and Health

In Module Three, you will submit your first milestone, in which you will evaluate the company’s recent financial performance and current financial health given

its organizational context. This milestone will be graded with the Milestone One Rubric.

Milestone Two: Success Factors and Risks

In Module Five, you will discuss factors that may affect current and future performance. This milestone will be graded with the Milestone Two Rubric.

Milestone Three: Projections

In Module Seven, you will forecast future performance based on what you know about the company’s financial health and performance. You will then modify

your projections for a best and worst case scenario, and discuss how your methodologies affect your projections. This milestone will be graded with the

Milestone Three Rubric.

Final Submission: Organizational Financial Analysis

In Module Nine, you will submit your final project. It should be a complete, polished artifact containing all of the critical elements of the final product. It

should reflect the incorporation of feedback gained throughout the course. This submission will be graded with the Final Product Rubric.

Deliverables

Milestone Deliverable Module Due Grading

One Financial Performance and Health Three Graded separately; Milestone One Rubric

Two Success Factors and Risks Five Graded separately; Milestone Two Rubric

Three Projections Seven Graded separately; Milestone Three Rubric

Final Submission: Financial Health and

Performance of an Organization

Nine Graded separately; Final Project Rubric

Final Project Rubric

Guidelines for Submission: Your financial health and performance report should be approximately 12–15 pages (excluding title page, spreadsheets and graphs,

and references list). It should be double-spaced, with 12-point Times New Roman font and one-inch margins, and use the latest guidelines for APA formatting for

references and citations. Include your name, course name, and report title on the title page.

Professional homework help features

Our Experience

However the complexity of your assignment, we have the right professionals to carry out your specific task. ACME homework is a company that does homework help writing services for students who need homework help. We only hire super-skilled academic experts to write your projects. Our years of experience allows us to provide students with homework writing, editing & proofreading services.

Free Features

Free revision policy

$10Free bibliography & reference

$8Free title page

$8Free formatting

$8How our professional homework help writing services work

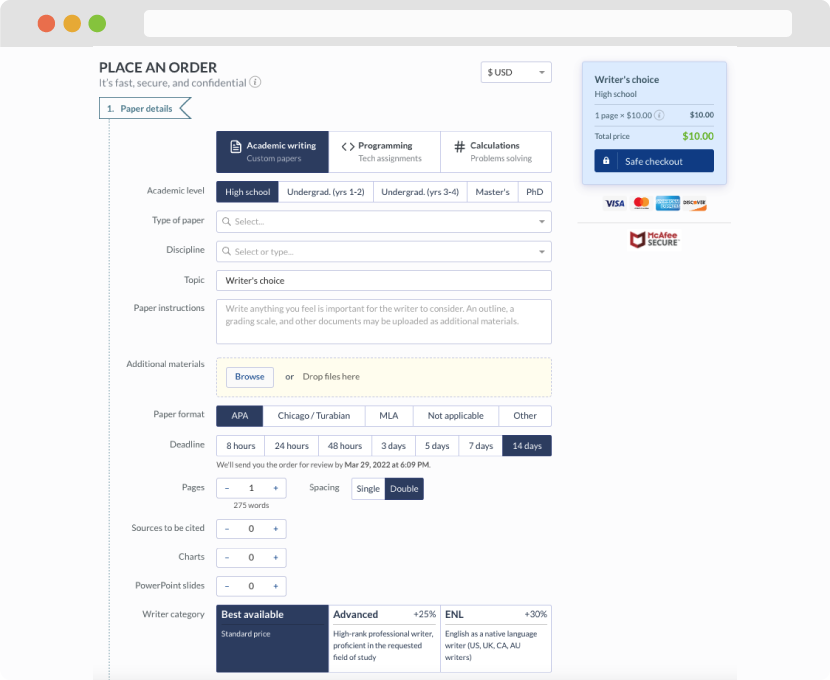

You first have to fill in an order form. In case you need any clarifications regarding the form, feel free to reach out for further guidance. To fill in the form, include basic informaion regarding your order that is topic, subject, number of pages required as well as any other relevant information that will be of help.

Complete the order form

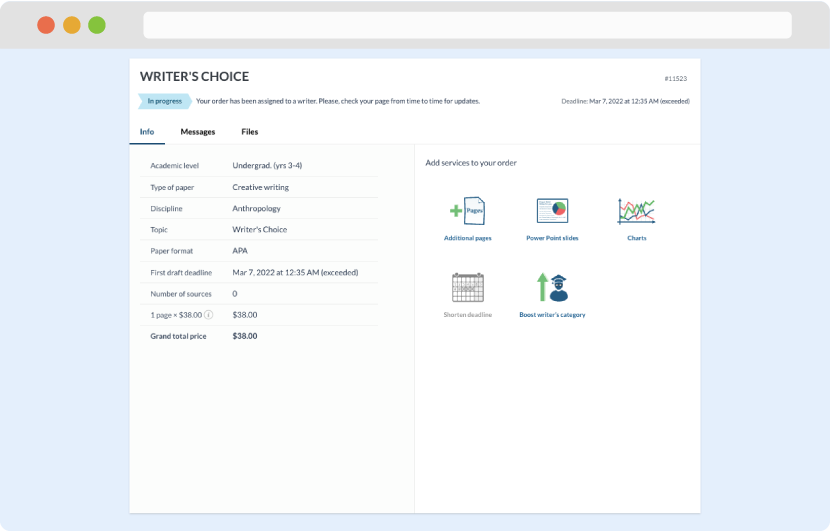

Once we have all the information and instructions that we need, we select the most suitable writer for your assignment. While everything seems to be clear, the writer, who has complete knowledge of the subject, may need clarification from you. It is at that point that you would receive a call or email from us.

Writer’s assignment

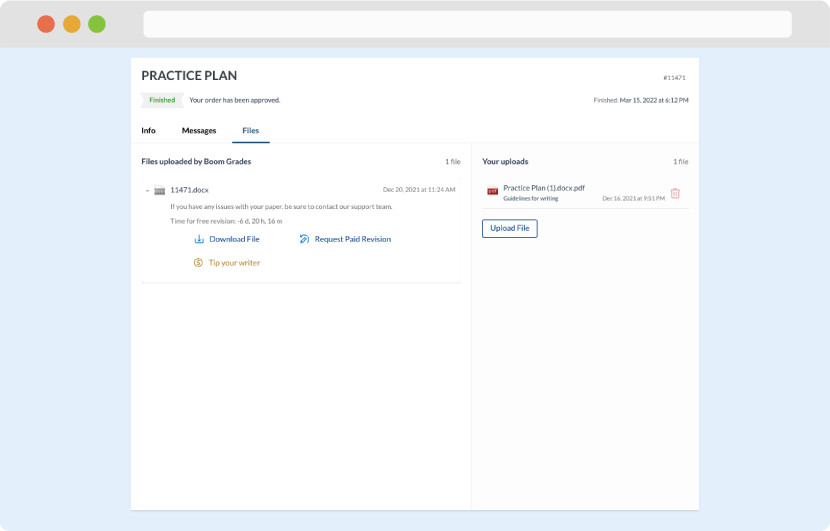

As soon as the writer has finished, it will be delivered both to the website and to your email address so that you will not miss it. If your deadline is close at hand, we will place a call to you to make sure that you receive the paper on time.

Completing the order and download